Table of Contents

- Introduction

- Understanding MCG Property Tax Calculation in Gurugram

- Property Tax Rates in Gurugram

- MCG property tax online payment

- MCG Property Tax Offline Payment

- Property Tax Exemptions in Gurugram

- Rebate on Property Tax in Gurugram

- Penalty on MCG Property Tax

- Conclusion

- Faq's

Introduction

Gurugram, often referred to as the Millennium City, mandates property owners to contribute to the city's development through the payment of property tax. The Municipal Corporation of Gurugram (MCG) oversees the collection of this tax, serving as a crucial source of revenue for various civic amenities and infrastructure projects. Property tax is determined based on the size and usage of individual plots, excluding religious properties from the levy.

Whether you own a residential or commercial property in Gurugram or are about to consider looking for homes in Gurugram, understanding the process of paying property tax is essential. The MCG facilitates a convenient system that allows property owners to fulfill their tax obligations through both online and offline channels. This article aims to guide residents through the comprehensive process of calculating property tax and offers step-by-step instructions for seamless payments, catering to diverse preferences and ensuring compliance with the city's taxation regulations.

Understanding MCG Property Tax Calculation in Gurugram

In 2013, the Municipal Corporation of Gurugram (MCG) implemented an accessible system aimed at simplifying the property tax calculation process for residents. This user-friendly approach was introduced to enhance the ease with which individuals could navigate through the taxation system and fulfill their obligations seamlessly.

The calculation of MCG property tax is intricately designed, taking into consideration specific rates that apply to various types of properties. Notably, Gurugram, along with cities like Faridabad, falls under the classification of Type A1 cities. In such cities, the tax rates applicable to similar properties are uniform.

It is imperative to highlight that the taxation structure distinguishes between self-use residential properties of medium and small sizes and larger commercial properties. In this regard, the tax rates for the former category are comparatively lower than those applicable to the latter. This differentiation in tax rates reflects the MCG's commitment to a fair and proportional taxation system that considers the diverse nature of properties within the city.

Property Tax Rates in Gurugram

|

Property Type |

Area (in sq yard) |

Tax levied (in Rs per sq yard) |

|

Residential Property |

Up to 300 |

Rs. 1 |

|

Residential Property |

301 to 500 |

Rs. 4 |

|

Residential Property |

501 to 1000 |

Rs. 6 |

|

Residential Property |

1001 to 2 acres | Rs. 7 |

|

Residential Property |

More than 2 acres | Rs. 10 |

|

Property Type |

Plot size |

Tax levied (in Rs per sq yard) |

|

Residential Plots |

Up to 100 |

Exempted |

|

Residential Plots |

101 to 500 |

Rs. 0.50 |

|

Residential Plots |

501 and above |

Rs. 1 |

|

Property Type |

Area (in sq yard) |

Tax levied (in Rs per sq yard) |

|

Commercial Property |

Up to 1000 |

Rs. 12 |

|

Commercial Property |

More than 1000 |

Rs. 15 |

|

Property Type |

Area (in sq yard) |

Tax levied (in Rs per sq yard) |

|

Commercial Shops |

Up to 50 |

Rs. 24 |

|

Commercial Shops |

51 to 100 |

Rs. 36 |

|

Commercial Shops |

101 to 500 |

Rs. 48 |

|

Property Type |

Plot size |

Tax levied (in Rs per sq yard) |

|

Commercial Plots |

Up to 500 |

Exempted |

|

Commercial Plots |

101 sq yards and above |

Rs. 5 |

|

Commercial Plots |

501 sq yards and above |

Rs. 2 |

Let's delve into the property tax rates applicable to various properties in Gurugram

Residential Properties

Gurugram imposes property taxes based on the size of residential properties. The tax rates vary according to the area in square yards, as outlined in the table above. Notably, larger properties, especially those exceeding 2 acres, incur a higher tax of Rs. 10 per square yard.

1 sq yard equals 9 sq ft.

Residential Plots

For residential plots, the tax structure differs. Smaller plots up to 100 sq yards are exempted, while those ranging from 101 to 500 sq yards incur a tax of Rs. 0.50 per square yard. Plots exceeding 501 sq yards are taxed at Rs. 1 per square yard.

Commercial Properties

Commercial properties face a distinct taxation system. The tax rate for areas up to 1000 sq yards is Rs. 12 per square yard, while properties exceeding 1000 sq yards are subject to a higher tax of Rs. 15 per square yard.

Ground Floor of Commercial Shops

Gurugram's ground floor commercial shops have their own tax structure based on the area. Smaller spaces up to 50 sq yards are taxed at Rs. 24 per square yard, while larger areas from 51 to 100 sq yards and 101 to 500 sq yards face tax rates of Rs. 36 and Rs. 48 per square yard, respectively.

Commercial, Industrial, and Institutional Plots

Lastly, plots designated for commercial, industrial, and institutional use follow a unique taxation pattern. Plots up to 500 sq yards are exempted, those above 500 sq yards but less than 101 sq yards face a tax of Rs. 5 per square yard, and plots exceeding 501 sq yards are taxed at Rs. 2 per square yard.

MCG property tax online payment

Facilitating the convenience of residents, the Municipal Corporation has streamlined the process of MCG property tax payments through an accessible online platform. Here is an elaborate guide outlining the step-by-step procedure for MCG property tax online payment:

Step 1: Access the Official Municipal Corporation Website

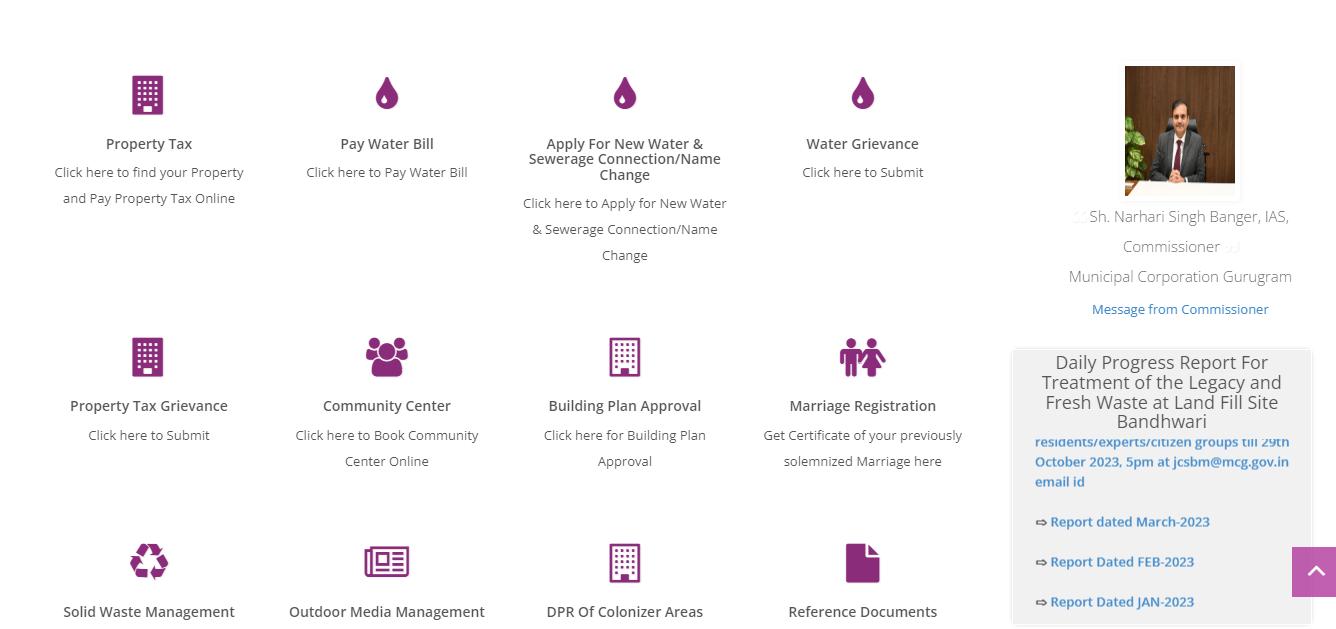

Initiate the online payment process by visiting the official website of the Municipal Corporation. The website serves as a centralized platform for various civic services, including property tax payments.

Step 2: Navigate to the Property Tax Section

Locate the dedicated property tax tab prominently positioned on the left side of the website interface. Click on this tab to proceed to the property tax payment section.

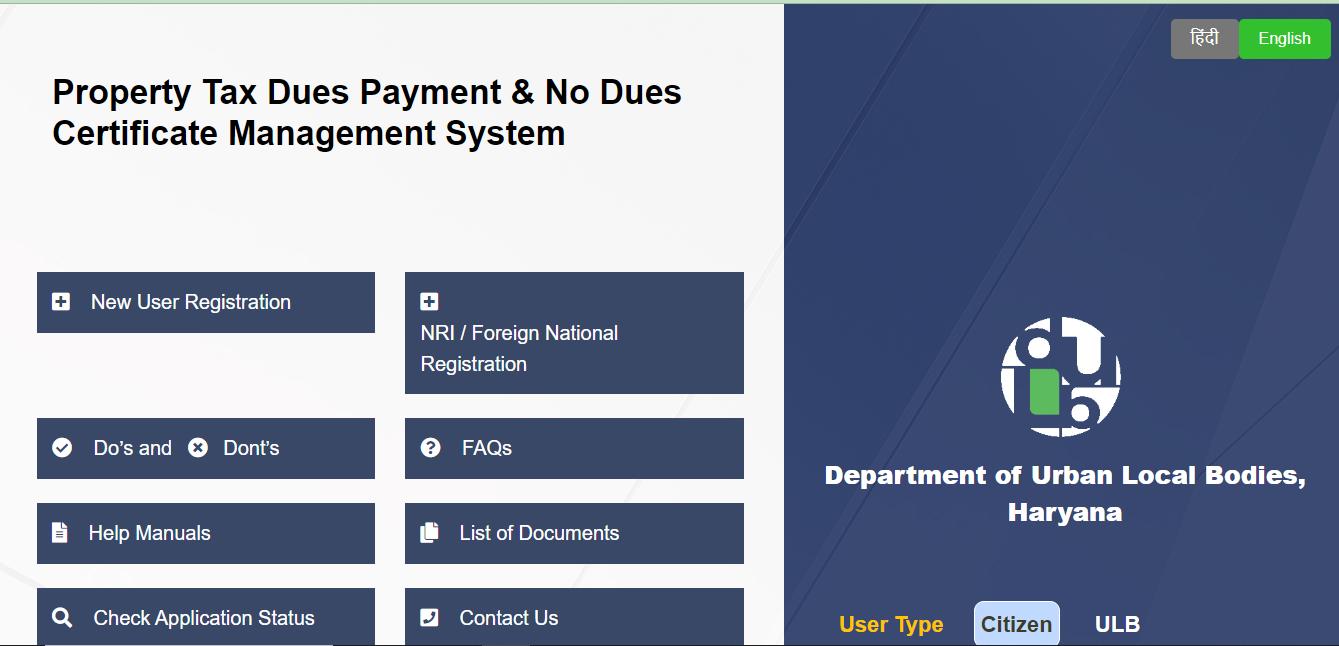

Step 3: Secure Login Credentials

Ensure a secure login by entering your credentials, which may involve specifying your login type and providing your registered mobile number. This step ensures the protection of your personal information during the payment process.

Step 4: Choose Property Identification Method

On the subsequent page, you will encounter options for identifying your property. Select either your unique property ID or enter your property address, locality, and the owner's name to proceed.

Step 5: View Tax Details

Once the property is identified, the system will display the detailed tax information on the screen. Carefully review the displayed details to ascertain the accuracy of the payable amount.

Step 6: Verify Payable Amount

It is imperative to meticulously review the payable amount before proceeding with the transaction. Ensure that all relevant components of the property tax are correctly represented.

Step 7: Select Payment Method

Choose your preferred mode of payment for MCG house tax. The online platform typically offers options such as credit/debit card or net banking to facilitate a seamless transaction.

Step 8: Complete the Transaction

After selecting the payment method, proceed to make the MCG house tax online payment. Upon the successful completion of the transaction, a digital receipt for the property tax payment will be generated. It is advisable to save this receipt for future reference and record-keeping purposes.

MCG Property Tax Offline Payment

Navigating the MCG house tax payment offline provides property owners with an alternative to the online process. Below are the detailed steps for MCG property tax offline payment:

Step 1: Visit Property Tax Collection Centers

Embark on the offline payment process by heading to the Property Tax Collection centers, also referred to as Citizen Facilitation Centres, strategically located throughout the city. These centers serve as designated points for in-person transactions related to property tax payments.

Step 2: Oriental Bank of Commerce Branch Visit

An alternative offline payment option involves visiting any Oriental Bank of Commerce branch within the city. This bank serves as a designated partner for MCG property tax payments, offering a convenient avenue for residents to fulfill their tax obligations.

Step 3: Verification of Property Details

Upon reaching the offline payment centers, representatives will assist in the verification of specific property details. It is imperative to present the necessary documents and information to facilitate a smooth verification process.

Step 4: Completion of Payment

Once the verification is completed, proceed to make the MCG property tax payment through the designated offline channels. Following the successful transaction, you will be issued an MCG property tax receipt as proof of payment.

Step 5: Payment Deadline

It is crucial to be mindful of the deadline for MCG property tax payment, which is set for July 31st of the respective assessment year. Timely payment ensures compliance with the stipulated schedule and helps avoid any potential penalties.

Property owners have the flexibility to choose offline modes for MCG property tax payment, whether through designated centers or partnering banks. Regardless of the chosen mode, it is crucial to generate the MCG property tax challan after a successful payment, serving as an essential document for future reference and documentation purposes. This offline payment process ensures a hassle-free and accessible avenue for property tax compliance.

Property Tax Exemptions in Gurugram

In Gurugram, certain exemptions under property tax are granted by the Haryana Government, demonstrating a recognition of specific categories deserving of relief. Here are the details and an expanded explanation of these exemptions:

Freedom Fighters and Spouses

- Eligibility: Freedom fighters and their spouses are eligible for property tax exemption if they reside in a self-occupied house.

- Rationale: This exemption recognizes and honors the contributions of freedom fighters by providing them with financial relief in the form of property tax exemption.

Defense and Paramilitary Personnel

- Eligibility: Individuals who have served in defense or paramilitary forces, as well as veterans in defense units, and their spouses who have served in corresponding positions.

- Rationale: This exemption acknowledges the sacrifices and service of those who have dedicated their lives to safeguarding the nation. It extends to both serving and retired personnel and their spouses, aiming to ease their financial responsibilities.

Families of Deceased Soldiers

- Eligibility: Families of deceased soldiers qualify for property tax exemption under the condition that they do not own any other residential property in Haryana and reside in the self-occupied house without subletting it.

- Rationale: This exemption is a gesture of gratitude and support for the families who have lost their loved ones in service to the country. It provides financial relief and stability to those who have made significant sacrifices.

Religious Developments

- Eligibility: Buildings and land associated with religious developments such as temples, gurudwaras, mosques, or churches are exempt from property tax.

- Rationale: Recognizing the importance of religious institutions in fostering community and cultural values, this exemption promotes the free operation of these entities without the burden of property tax.

Rebate on Property Tax in Gurugram

Property owners in Gurugram have the chance to avail themselves of rebates on their property taxes, offering them financial incentives for adhering to timely payment schedules. Below, you'll find comprehensive details and an in-depth explanation of the rebates at their disposal.

One-Time Rebate for Clearing Arrears

- Rebate Percentage: A substantial one-time rebate of 30 percent is extended to property owners who promptly clear all their property tax arrears within 45 days of the issuance of the notification.

- Rationale: This significant rebate serves as a motivating factor for property owners to settle any outstanding tax obligations promptly. It encourages swift action in clearing arrears, promoting financial responsibility and timely compliance.

Early Payment Rebate

- Rebate Percentage: A 10 percent rebate is offered to property owners who proactively pay their taxes before the deadline of July 31 in the respective assessment year.

- Rationale: The early payment rebate aims to reward property owners who adhere to the stipulated timeline for tax payment. This not only facilitates a smoother tax collection process for the municipal authorities but also incentivizes responsible financial behavior among property owners.

Penalty on MCG Property Tax

Failure to settle your outstanding property tax in Gurugram can result in financial consequences, including penalties and interest charges. Here are the details and an expanded explanation of the penalties associated with MCG property tax:

Penalty for Non-Payment

- Penalty Amount: If your property tax remains unpaid, a penalty equivalent to the evaded tax amount will be imposed. This penalty is in addition to the outstanding Gurugram property tax.

- Expanded Explanation: The imposition of a penalty mirrors the gravity of non-payment, acting as a deterrent to ensure property owners fulfill their tax obligations promptly. The penalty is calculated based on the amount of tax evaded, serving as both a punitive measure and an incentive for compliance.

Interest on Late Payment

- Interest Rate: In the event of late payment, an interest charge at the rate of 1.5% per month will be applied to the due amount.

- Expanded Explanation: The interest on late payment is designed to compensate for the delayed receipt of property tax funds. This interest rate is applied monthly, encouraging property owners to adhere to the specified payment deadlines and discouraging delays in settling their tax obligations.

Interest on Wrong Declaration

- Interest Levied: If a wrong declaration is detected, interest will be levied in addition to the penalty.

- Expanded Explanation: In cases where incorrect information is provided or discrepancies are identified in the declaration, interest charges are applied. This measure emphasizes the importance of accurate and transparent reporting, ensuring the integrity of the property tax assessment process.

Conclusion

In conclusion, for homeowners in Gurugram, understanding and adhering to property tax regulations are integral aspects of responsible citizenship and community development. The user-friendly tax calculation system, coupled with online and offline payment options, provides convenience. Leveraging exemptions and rebates can be advantageous, emphasizing the city's recognition of unique circumstances. Timely compliance not only avoids penalties but also contributes to the sustained growth and enhancement of civic amenities in Gurugram. Homeowners' proactive engagement in property tax responsibilities is not just a financial obligation but a meaningful contribution to the overall well-being and progress of the community they are an integral part of.

explore further

Latest from Home Buying Tips

More from Recommendations

Resources

Dwello, for every home buyer, is a way to go from 'I feel' to 'I know', at no extra cost.