Table of Contents

- Introduction

- What is Capital Gain Indexation?

- How Does Capital Gain Indexation Work?

- Benefits of Capital Gain Indexation

- Factors Influencing Capital Gain Indexation

- Tips for Maximizing Indexation Benefits

- Example

- Conclusion

- Faq's

Introduction

Capital gain indexation is a powerful tool utilized by investors to mitigate the impact of inflation on their investment returns. Understanding how it works and its implications is crucial for making informed financial decisions. In this article, we delve into the intricacies of capital gain indexation, providing insights, charts, and tables to facilitate comprehension.

Indexation Formu

Indexation Formu

What is Capital Gain Indexation?

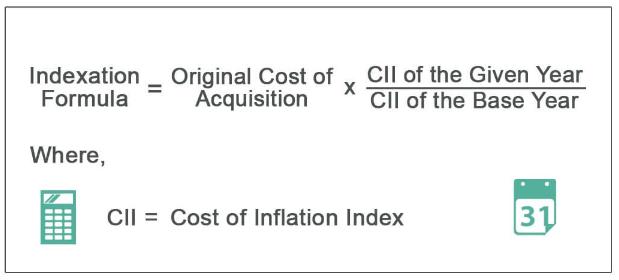

Capital gain indexation is a method used to adjust the purchase price of an asset for inflation, thereby reducing the taxable portion of the capital gain when the asset is sold. This adjustment is based on the Cost Inflation Index (CII) published by the government, which reflects changes in the cost of living over time.

How Does Capital Gain Indexation Work?

When calculating capital gains tax on long-term assets, the indexed cost of acquisition is determined by multiplying the original purchase price by the ratio of the CII of the year of sale to the CII of the year of purchase. This adjusted cost is then subtracted from the selling price to arrive at the indexed capital gain, which is taxed at a lower rate compared to non-indexed gains.

Benefits of Capital Gain Indexation

Reduces tax liability: By accounting for inflation, investors pay taxes only on the real gains accrued over the holding period.

Encourages long-term investment: Indexation incentivizes investors to hold assets for a longer duration, fostering stability in financial markets.

Preserves purchasing power: Indexing ensures that the after-tax proceeds from the sale of an asset maintain their purchasing power over time.

Factors Influencing Capital Gain Indexation

Several factors can impact the effectiveness of capital gain indexation, including the duration of asset ownership, the rate of inflation, and changes in government policies regarding taxation and indexation methodologies.

Tips for Maximizing Indexation Benefits

Invest for the long term: Holding assets for longer periods enhances the benefits of indexation by reducing the effective tax rate on capital gains.

Keep meticulous records: Accurate documentation of purchase and sale transactions is essential for calculating indexed costs and complying with tax regulations.

Seek professional advice: Consultation with tax experts and financial advisors can help optimize indexation strategies and minimize tax liabilities.

Example

Let's consider an example to illustrate how capital gain indexation works:

Suppose you purchased a piece of real estate in 2010 for ₹10,00,000. After holding the property for ten years, you decide to sell it in 2020 for ₹15,00,000. Without indexation, your capital gain would be ₹5,00,000 (₹15,00,000 - ₹10,00,000). However, by applying indexation, the calculation changes.

Let's assume that the Cost Inflation Index (CII) for the year of purchase (2010) was 200, and for the year of sale (2020) was 300.

Indexed Cost of Acquisition = Original Purchase Price × (CII of Sale Year / CII of Purchase Year)

Indexed Cost of Acquisition = ₹10,00,000 × (300 / 200) = ₹15,00,000

Indexed Capital Gain = Selling Price - Indexed Cost of Acquisition

Indexed Capital Gain = ₹15,00,000 - ₹15,00,000 = ₹0

In this example, with the application of capital gain indexation, your indexed capital gain is zero, resulting in no capital gains tax liability.

Conclusion

Capital gain indexation is a valuable tool for investors seeking to optimize their tax planning and preserve the real value of their investment returns. By understanding the principles and mechanisms of indexation, individuals can navigate the complexities of taxation with confidence and efficiency.

explore further

Latest from Contemporary ideas

More from Innovations

Resources

Dwello, for every home buyer, is a way to go from 'I feel' to 'I know', at no extra cost.