Table of Contents

- Introduction

- Understanding Stamp Duty

- Stamp Duty Rates

- Significance of NDMC and Delhi Cantonment Board

- House Registration Charges

- Factors Affecting Stamp Duty and Registration Charges

- Calculating Stamp Duty and Registration Charges

- Paying Stamp Duty and Registration Charges Online

- Documents Required for Property Registration

- Conclusion

- Faq's

Introduction

In the bustling real estate landscape of Delhi, where opportunities abound and properties change hands daily, understanding the finer points of stamp duty and property registration charges is paramount. Whether you're a seasoned investor or a first-time buyer, navigating the intricacies of these financial aspects can often seem daunting. However, fear not, for this comprehensive guide is here to illuminate the path ahead.

Delhi's real estate market is dynamic, with rates, regulations, and calculations constantly evolving. In this ever-changing landscape, having a firm grasp of stamp duty and property registration charges can make all the difference. That's where this guide comes in. Our aim is not only to demystify these complex concepts but also to empower you with the knowledge needed to traverse the real estate terrain with confidence.

From understanding the varying rates based on property type and owner's gender to deciphering the significance of jurisdictional differences and exploring the impact of government initiatives, we leave no stone unturned. By shedding light on these intricacies, we equip you with the tools to make informed decisions and navigate the process seamlessly.

Understanding Stamp Duty

Stamp duty plays a crucial role in property transactions across Delhi, being levied on properties acquired through various means such as gift deeds, conveyance, or sale deeds. Its rate varies significantly based on several factors, including the type of property and the gender of the owner. These rates are set by the Delhi government and are subject to periodic revisions to align with market trends and policy objectives. Understanding the intricacies of stamp duty is essential for individuals engaging in property transactions, as it can significantly impact the overall cost and legality of the transaction. Proper assessment and compliance with stamp duty regulations are imperative to ensure a smooth and legally sound property transfer process in the capital city.

Stamp Duty Rates

|

Category |

Stamp Duty Rate |

|

Male |

6 percent |

|

Female |

4 percent |

|

Joint |

5 percent |

Significance of NDMC and Delhi Cantonment Board

The New Delhi Municipal Council (NDMC) and Delhi Cantonment Board play significant roles in the governance and administration of specific areas within Delhi. Properties located within their jurisdictions often experience variations in stamp duty and registration charges compared to other areas in the city. For instance, properties falling under the purview of the NDMC are subject to fixed rates for stamp duty and registration charges, with additional considerations for lower charges applicable to female owners. These variations reflect the unique regulatory frameworks established by these administrative bodies to manage property transactions effectively and ensure equitable treatment for property owners within their respective jurisdictions.

Understanding the influence of the NDMC and Delhi Cantonment Board on stamp duty and registration charges is essential for individuals engaging in property transactions within their areas of authority. Proper awareness of these jurisdictional nuances can help individuals make informed decisions regarding property acquisitions, ensuring compliance with applicable regulations and optimizing cost considerations. Additionally, seeking guidance from legal and real estate professionals familiar with the intricacies of these administrative bodies can further facilitate smooth and legally sound property transactions within the NDMC and Delhi Cantonment Board areas.

|

Jurisdiction |

Male Owner |

Female Owner |

|

NDMC |

5.5 Percent |

3.5 Percent |

|

Delhi Cantonment Board |

3 Percent |

3 Percent |

House Registration Charges

In Delhi, property registration charges play a crucial role in the legal transfer of ownership. These charges are calculated based on the current market value of the property being registered. Typically, the registration fee amounts to 1% of either the consideration amount agreed upon between the buyer and seller or the value as per the circle rate set by the government, whichever is higher. This mechanism ensures that the government receives a fair share of revenue from property transactions while also preventing undervaluation of properties to evade taxes.

The determination of property registration charges based on the higher value between the consideration amount and the circle rate aims to maintain transparency and fairness in property transactions across Delhi. It provides a standardized approach to assessing registration fees, ensuring consistency and compliance with regulatory requirements. Additionally, this practice helps in curbing instances of tax evasion and ensuring that property transactions contribute equitably to the government's revenue stream, thereby supporting various developmental initiatives and public services in the capital city.

Factors Affecting Stamp Duty and Registration Charges

Stamp duty and registration charges in Delhi are subject to several factors that can significantly impact their calculation. One of the primary determinants is the property's location within the city, with different areas often having distinct rates set by the local authorities such as the Delhi government or administrative bodies like the New Delhi Municipal Council (NDMC) and the Delhi Cantonment Board. Additionally, the age of the property owner can also influence these charges, as some jurisdictions may offer concessions or exemptions to senior citizens or certain categories of individuals.

Moreover, the gender of the property owner can also play a role in stamp duty and registration charges, with lower rates often applicable to female owners as a means to promote gender equality and empower women in property ownership. Another critical factor is the type of property being transacted, whether residential or commercial, as each category may have its own set of rates and regulations governing stamp duty and registration charges. These factors collectively contribute to the complexity of determining the final costs associated with property transactions in Delhi, underscoring the importance of thorough research and consultation with legal and real estate professionals to ensure compliance and optimize financial considerations.

Calculating Stamp Duty and Registration Charges

For prospective property buyers in Delhi, leveraging online resources and stamp duty calculators can provide valuable insights into the estimated charges associated with their intended purchase. These tools typically require inputting specific details about the property, such as its location, type, and value, to generate an approximate figure for stamp duty and registration charges. By utilizing these resources, buyers can better understand the financial implications of their investment and plan accordingly.

One crucial factor to consider when calculating stamp duty and registration charges is the circle rate established by the government. The circle rate serves as a benchmark for property values in a particular area and plays a pivotal role in determining registration fees. It is essential for buyers to stay informed about the latest guidelines and updates regarding circle rates to ensure accurate calculations. Regular updates ensure that buyers have access to the most current information, enabling them to make well-informed decisions and avoid discrepancies during the property registration process. By staying informed and utilizing available online tools, prospective buyers can navigate the complexities of stamp duty and registration charges more effectively, facilitating a smoother transaction process.

Paying Stamp Duty and Registration Charges Online

Step-by-Step Guide to Online Payment of Stamp Duty and Registration Charges in Delhi

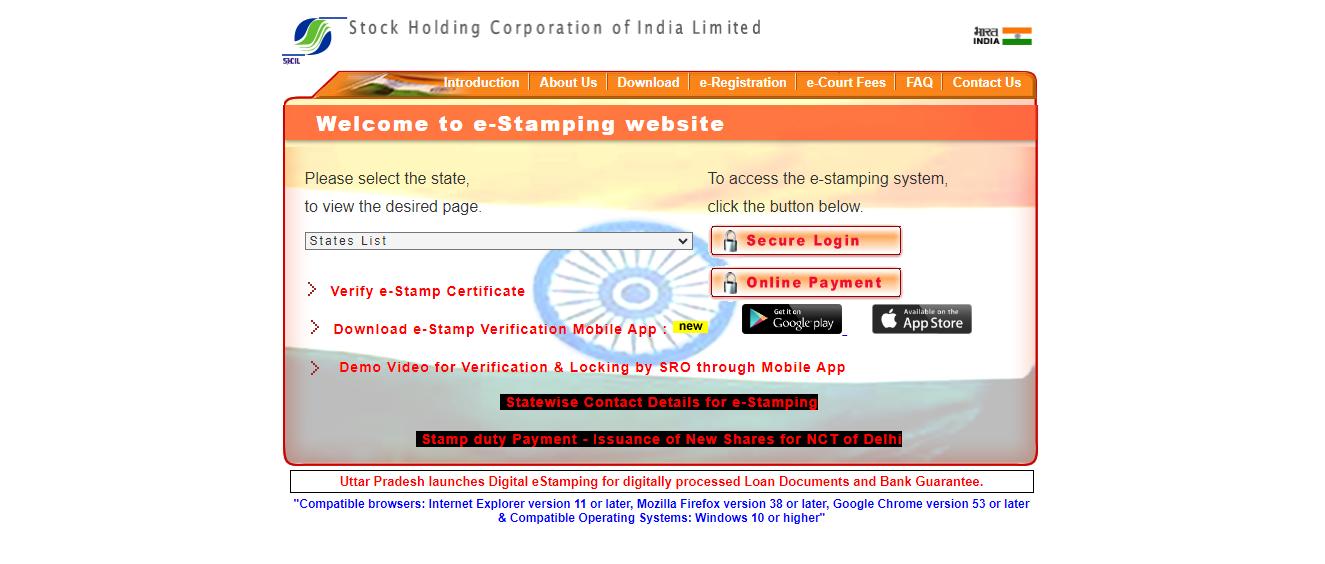

Access the Official Portal: Stock Holding Corporation Ltd

Choose Your Location:

On the website, select the 'NCT of Delhi' from the dropdown list of states. This ensures that your payment is processed under the correct jurisdiction of Delhi.

Execute the Payment:

Once your location is specified, proceed to execute the payment. The website provides various payment methods, including UPI, NEFT, IMPS, Debit Card, and Credit Card. Choose the option that suits your convenience best, reflecting the platform's commitment to accommodating diverse user preferences.

Documents Required for Property Registration

To complete the property registration process in Delhi, several essential documents must be submitted. These documents serve as proof of ownership and facilitate the legal transfer of the property from the seller to the buyer. Here are the key documents required:

- Sale deed: The sale deed is a legal document that officially transfers the ownership of the property from the seller to the buyer. It contains details such as the property description, sale consideration, and terms of the transaction.

- Proof of TDS payment: If applicable, proof of Tax Deducted at Source (TDS) payment must be provided. TDS is deducted from the sale consideration amount and deposited with the income tax department by the buyer.

- ID and address proofs: Both the buyer and seller must provide valid identification and address proofs, such as Aadhaar card, voter ID card, passport, or driver's license, to verify their identities and residential addresses.

- Passport-size photographs: Recent passport-sized photographs of the buyer and seller are required for documentation purposes.

- E-stamp paper: E-stamp paper is used to create legal agreements or documents, including the sale deed. The appropriate denomination of e-stamp paper must be purchased based on the transaction value.

- PAN card: The PAN (Permanent Account Number) card of both the buyer and seller is necessary for property registration. PAN details are used for tax purposes and must be provided as per regulatory requirements.

- Registration fee receipt: Proof of payment of the registration fee, which is typically calculated based on the property value or circle rate, must be provided.

Ensuring the timely submission of these documents is crucial for a smooth and legally compliant property registration process in Delhi. Buyers and sellers are advised to gather and organize these documents in advance to facilitate efficient completion of the registration procedure.

Conclusion

In conclusion, comprehending stamp duty and property registration charges in Delhi is indispensable for prospective property buyers seeking to navigate the real estate landscape effectively. By familiarizing themselves with the rates, calculations, and procedures involved, buyers can make informed decisions and facilitate seamless transactions. The initiatives undertaken by the government to promote women's homeownership and streamline the payment process contribute to fostering a transparent and inclusive real estate environment in Delhi.

explore further

Latest from Home Buying Tips

More from Recommendations

Resources

Dwello, for every home buyer, is a way to go from 'I feel' to 'I know', at no extra cost.