Table of Contents

- Introduction

- What is Guidance Value?

- Latest Update on Guidance Value in Bangalore

- How is the Guidance Value Calculated ?

- Calculation Of Guidance Value with Example

- Impact of Guidance Value on Real Estate Investments

- How Does an Increase in Guidance Value impact Property Tax?

- Property tax calculation to remain zonal: BBMP

- What Factors Influence Guidance Value?

- Examples of Guidance Value Rates in Bangalore for Different Property Types:

- Difference Between Market Value and Guidance Value

- Conclusion

- Faq's

Introduction

In the bustling real estate landscape of Karnataka, prospective property buyers and sellers navigate a critical parameter known as the Guidance Value. Also referred to as the Ready Reckoner (RR) rate or Circle rate in other states, this value represents the minimum price set for property transactions, meticulously regulated by the Department of Stamps and Registration. With its significance deeply embedded in the state's real estate transactions, understanding the intricacies of Guidance Value, its calculation methodology, its pivotal role in property dealings, and its evolution over time becomes imperative.

This article delves into the definition, calculation process, importance, and recent changes in Guidance Value within Karnataka's real estate domain, offering a comprehensive guide for stakeholders navigating the dynamic property market of the state.

What is Guidance Value?

Guidance Value, also known as the Ready Reckoner (RR) rate or Circle rate in other states, is the minimum value that a homebuyer has to pay for a property in Karnataka. It is regulated by the Department of Stamps and Registration and is derived on both land parcels and constructed properties. The value is computed on the basis of available land area, excluding any constructed property, and the value assessed for the constructed properties including the land is termed the composite value. It is periodically revised as per the prevailing real estate market conditions. Read on to know the latest updates of guidance value in Bangalore.

Latest Update on Guidance Value in Bangalore

Since October 2023, the guidance value in Karnataka has been increased.

Type | Guidance value increase |

|---|---|

Agricultural land | Up to 50% |

Sites | 5- 30% |

Apartment | 5-20% |

As a result of the growing demand in the real estate sector, the Karnataka government intends to increase guidance values for the sector. As part of its online registration push, Bengaluru is also implementing the web-based application Kaveri 2.0.

The stamps and registration department in Karnataka keeps a close eye on the guidance value, especially in bustling areas like Bangalore. They make it a point to update these values regularly to ensure they reflect the current market rates of properties. This meticulous process aims to curb any shady dealings involving black money and cash transactions, which could potentially impact the state's revenue. Whether you're eyeing a property in Bangalore or any other part of Karnataka, it's wise to stay updated with the latest Kaveri guideline values. These values serve as a crucial reference point when it comes to calculating stamp duty and registration charges during property transactions at the sub-registrar office. So, before diving into any real estate deals, make sure to check the most recent Kaveri guidance value to make informed decisions and avoid any surprises along the way.How is the Guidance Value Calculated ?

Guidance Value Calculation - Bengaluru

Guidance Value Calculation - Bengaluru

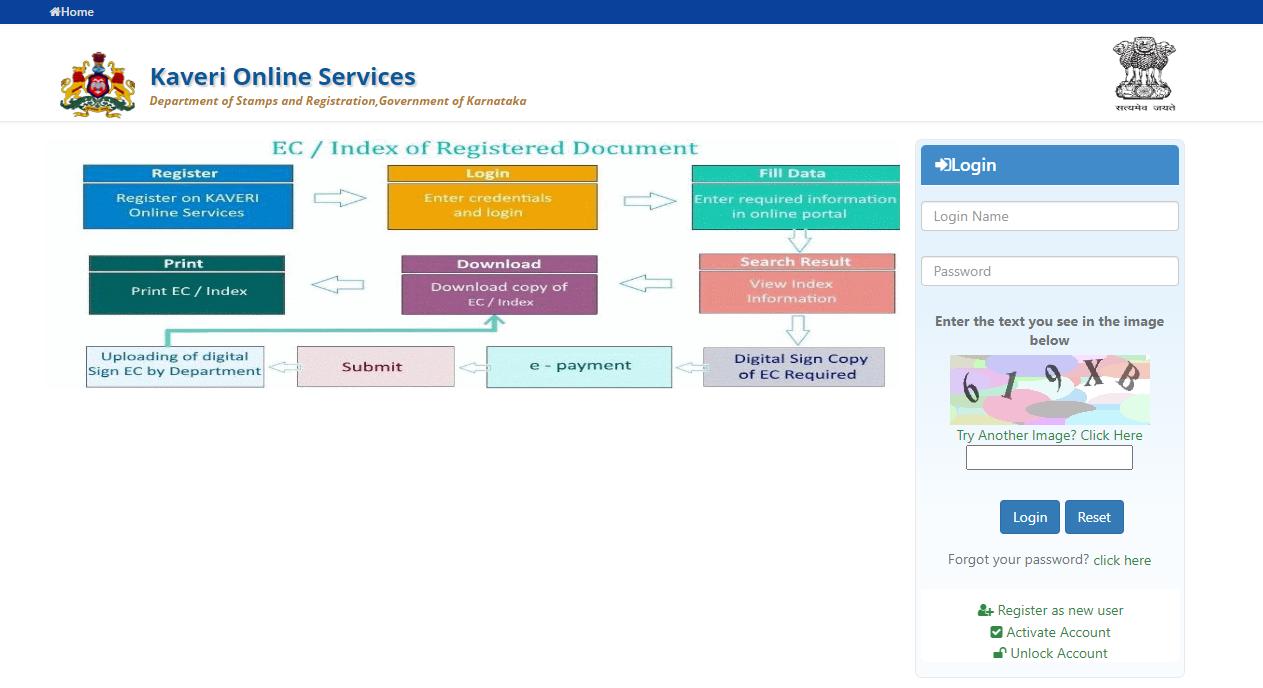

The Stamps and Registration department has introduced KAVERI, an online platform facilitating guidance value computation specifically tailored for Bangalore. To utilize this resource:

- Begin by visiting the official website of KAVERI at kaverionline.karnataka.gov.in.

Kaveri Online Services - Old Layout

Kaveri Online Services - Old Layout - Look for the Know Your Property Valuation section.

- On the homepage, you'll encounter two search options: Basic Search and Advanced Search.

- Opt for 'District' from the dropdown menu provided on the website.

- Under the 'Area Name' tab, select your specific area.

- Choose from the available options such as Property Usage Type, Total Area, and Measurement Unit.

- If using the Advanced Search mode, provide additional details like Registration District and SRO Office.

Please note that Kaveri guidance values are derived from surveys and evaluations undertaken by the state government. The current market conditions and potential of the location are also taken into account when estimating the guidance value.

Following these straightforward steps, prospective buyers can effectively utilize the KAVERI Guideline value portal to gain insights into applicable rates and accurately calculate the guidance value in Bangalore.

Also Read: Kaveri 2.0 Karnataka: Property Registration, Services, Benefits & More

Calculation Of Guidance Value with Example

Imagine a scenario where the market price of a property in a particular area is Rs 12,000 per square foot, and the Guidance Value set by the Revenue Department is Rs 8,000 per square foot. Here, the homebuyer has the flexibility to register the property within the range of Rs 8,000 per square foot to Rs 12,000 per square foot.

On the other hand, if a property is valued at Rs 6,000 per square foot in the market, but the Guidance Value is fixed at Rs 8,000 per square foot, the homebuyer cannot register the property below Rs 8,000 per square foot. This ensures that property transactions comply with the mandated Guidance Value, preventing any undervaluation during registration.

Impact of Guidance Value on Real Estate Investments

The guidance value of a property has a significant impact on real estate investments. It is the minimum selling price as fixed by the government and is determined by factors such as the type of structure and locality of the property. The guidance value can change the price of the property and influence real estate investments.

If the guidance value is higher, fewer people will be able to buy the property, and if it is lower, more people will be able to afford it. This can impact the selling price of properties and the profitability of sellers. For example, if the guidance value for a property is Rs. 1.50 Crore and a buyer is willing to pay Rs. 1.25 Crore, the buyer will still have to register the property at the guidance value of Rs. 1.50 Crore, resulting in an increased cash outflow for the buyer

The guidance value can also affect the profitability of sellers. If the guidance value is increased, sellers can gain a comfortable profit by selling their property at the new guidance value. However, they should consider that higher guidance values contribute to increased government revenue through stamp duty and registration charges

In the case of a buyer, an increase in guidance value can lead to higher stamp duty and registration charges, which can result in a larger budget for the buyer. Additionally, property taxes may also increase, leading to higher annual tax payments for property owners

How Does an Increase in Guidance Value impact Property Tax?

The increase in the guidance value of properties in Karnataka can have a significant impact on property taxes. In Karnataka, stamp duty is calculated at 5% of the guidance value, which means that any change in the guidance value will directly affect the stamp duty payable for a property transaction.

For example, if the guidance value for a property is increased by 25%, the stamp duty payable will also increase by 25%. This can result in higher cash outflows for buyers, as they will have to pay more in stamp duty and registration charges. Additionally, property taxes may also increase, as property tax is often calculated as a percentage of the guidance value. How does an increase in Guidance Value Impact Property taxes?

How does an increase in Guidance Value Impact Property taxes?

The increase in guidance value can also impact the profitability of sellers. If the guidance value is increased, sellers can gain a comfortable profit by selling their property at the new guidance value. However, they should consider that higher guidance values contribute to increased government revenue through stamp duty and registration charges, which can also impact their profitability.

In conclusion, the increase in guidance value can lead to higher property taxes, as stamp duty is calculated at 5% of the guidance value in Karnataka. This can result in higher cash outflows for buyers and may also impact the profitability of sellers. It is essential for buyers and sellers to understand the implications of the guidance value on property taxes and factor it into their real estate transactions.

Property tax calculation to remain zonal: BBMP

The Bruhat Bengaluru Mahanagara Palike (BBMP) had proposed to charge property tax on the basis of guidance value Bangalore starting from April 1, 2024, which would have replaced the current zonal method of property tax computation.

The proposed tax rates were

Property Type | Tax Rate |

Residential properties on rent | 0.2% of guidance value |

Self-occupied residential properties | 0.1% of guidance value |

Fully vacant land | 0.025% of guidance value |

Commercial properties | 0.5% of guidance value |

However, the Karnataka state government clarified on March 25, 2024, that property tax will continue to be charged based on the computational method, and Bangalore will not see any hike in property tax in 2024-25

In contrast to the rest of Karnataka, where property tax is levied based on the Kaveri Guidance Value, Bangalore falls under the BBMP jurisdiction, which previously employed a zonal division system for tax calculation. This approach often led to discrepancies, with some areas paying higher taxes despite similar built-up areas. While there were discussions to transition to a guidance value-based system to ensure uniformity and bolster state revenue for development purposes, the Karnataka state government has decided against pursuing this initiative.

Under the BBMP system, property tax is determined by dividing the city into five zonal divisions, labeled A to E. Initially, there were plans to phase out this method under Section 144 of the BBMP Act, 2020, in favor of adopting the guidance value-linked approach. However, this transition is not currently being pursued.

The guidance value in Bangalore is regulated by the Department of Stamps and Registration, Karnataka, and is derived on both land parcels and constructed properties. The stamp duty charges and registration fees are calculated on the guidance value and are considered the primary source of revenue for the government. The government revises the guidance value annually to diminish the gap between the two, which helps generate higher revenue through stamp duty and registration fees. Reducing the gap between the guidance value and the market rate also helps curb the black money circulation in the realty sector

In conclusion, the guidance value in Bangalore is a crucial factor that determines the property tax and registration fees. The proposed change in the method of property tax computation to the guidance value-based method was explored to bring in uniformity across the state and rake up the revenue, which in turn would be used for the state development. However, the Karnataka state government has decided to continue with the zonal method of property tax computation, and has clarified that Bangalore will not see any hike in property tax in 2024-25.

What Factors Influence Guidance Value?

For example in a city like Bangalore, the guidance value is influenced by several factors, including the demand and supply of properties, amenities, infrastructure, and government policies.

Demand and Supply of Properties: The guidance value of a property is directly proportional to the demand for it. If there is a high demand for properties in a particular area, the guidance value will be high. Conversely, if there is a low demand, the guidance value will be lower

Amenities: The presence of essential amenities such as shopping malls, parks, schools, and hospitals in an area increases the guidance value of a property. Properties located in areas with good amenities will have higher guidance values

Infrastructure: The quality of infrastructure in the surrounding area, including good roads, public transportation, and schools, can influence the guidance value of a property. Properties located in areas with robust infrastructure will have higher guidance values

Government Policies: The government can revise the guidance value periodically to reflect changes in the market. This can be due to changes in the real estate market, economic factors, or legal changes

Location: The location of a property is a significant factor in determining the guidance value. Properties located in prime areas or neighborhoods with high demand will have higher guidance values

Property Type and Usage: Different property types, such as residential, commercial, agricultural, or industrial, may have varying guidance values based on their usage and the local regulations

In short, the guidance value in Bangalore is influenced by a combination of factors, including demand and supply, amenities, infrastructure, government policies, location, and property type. Understanding these factors can help buyers and sellers make informed decisions when buying or selling properties in Bangalore

Examples of Guidance Value Rates in Bangalore for Different Property Types:

Agricultural Land:

The guidance value for agricultural land in Bangalore can vary based on factors such as fertility, accessibility, and proximity to urban areas. For instance, agricultural land located in the outskirts of Bangalore with good fertility and easy access to amenities may have a guidance value of Rs. 5 lakhs per acre.

Agricultural land will have different Guidance Value

Agricultural land will have different Guidance Value

Residential Sites:

Residential sites in Bangalore are typically assessed for guidance value based on factors like location, amenities, and size. For example, a residential site in a prime area like Indiranagar may have a guidance value of Rs. 2 crores per 2400 square feet.

Residential Sites will have different factors to calculate Guidance Value

Residential Sites will have different factors to calculate Guidance Value

Apartments:

Apartments in Bangalore are valued based on their location, amenities, and the overall market demand. An example of guidance value for a 2-bedroom apartment in a sought-after area like Koramangala could be around Rs. 1 crore.

These examples illustrate how guidance values can vary for different property types in Bangalore, reflecting the local market conditions, property characteristics, and demand in various areas of the city.

The Guidance Value of Apartments depend on various factors

The Guidance Value of Apartments depend on various factors

Difference Between Market Value and Guidance Value

Market value and guidance value are two important concepts in the real estate industry. Market value refers to the highest price a willing buyer would pay for a property or asset in a fair market, while guidance value is the minimum value for which a property can be registered. The below table will help you to get a better understanding of the differences between market value and guidance value, their determining factors, and their importance in the real estate sector.

Factor | Market Value | Guidance Value |

Definition | The highest price a willing buyer would pay for a property or asset in a fair market | The minimum value for which a property can be registered |

Determining Factors | Supply and demand, prevailing economic conditions, location, size, condition, amenities, and comparable sales | Local government's revenue department, locality, size of the property, amenities in the area, and other factors |

Purpose | Used in real estate transactions and investment appraisals | Used for stamp duty and registration charges |

Revisions | Frequency varies depending on the region or state | Subject to change over time based on various factors |

Importance | Used to determine the value of a property in the open market | Used to ensure transparency and fairness in property transactions |

Conclusion

In conclusion, Guidance Value in Karnataka is an essential aspect of the real estate sector, serving as the minimum price for property transactions.

In summary, the calculation of Guidance Value is based on land area and constructed properties, and the value is revised periodically to keep it in line with the market rate and therefore plays a crucial role in the real estate sector by setting the minimum price for property transactions, which can directly impact the market value of properties and influence real estate investments. As a result, It is essential for buyers and sellers to understand the guidance value and its implications on their real estate transactions

explore further

Latest from Editorials

More from Publications

Resources

Dwello, for every home buyer, is a way to go from 'I feel' to 'I know', at no extra cost.