Table of Contents

- Introduction

- Verify Project and Promoter Registration

- Scrutinize the Agreement for Sale

- Confirm Delivery Timelines for Amenities

- Understand the Implications of Project Delays

- Ensure Compliance with RERA Regulations

- Pro Tips for Homebuyers in 2025

- Conclusion

- Faq's

Introduction

Purchasing a home is a lifetime investment, and ensuring it is safe and transparent is paramount. The Maharashtra Real Estate Regulatory Authority (MahaRERA) provides an essential framework for safeguarding homebuyers' interests. In 2025, MahaRERA continues to empower buyers by enforcing rules that ensure accountability, transparency, and fairness in the real estate market.

This guide outlines the top 5 MahaRERA checks every homebuyer must perform before making a purchase. These checks are designed to help buyers make informed decisions while protecting their rights.

Verify Project and Promoter Registration

When purchasing property in Maharashtra, the first and most crucial step is ensuring that the real estate project and the promoter are registered with MahaRERA. This verification is not just a procedural formality but a legal safeguard for homebuyers. Registration with MahaRERA signifies that the project complies with regulatory standards and ensures greater transparency, accountability, and legal compliance.

Why It Matters

- Access to Comprehensive Information

- MahaRERA provides buyers with detailed insights into the project and promoter. This includes key documents such as layout plans, building approvals, financial disclosures, and timelines for completion. Having this data empowers buyers to make well-informed decisions and avoid hidden surprises later.

- Accountability

- Registered projects fall under the stringent supervision of MahaRERA. This ensures that promoters adhere to the declared timelines, approved plans, and other commitments. By enforcing these regulations, MahaRERA minimizes the risk of fraud or misleading claims by developers.

- Legal Protection

- A MahaRERA-registered project provides buyers with an additional layer of legal protection. If a promoter fails to deliver as promised or deviates from the approved plan, buyers have the right to file a formal complaint with MahaRERA, seeking resolution or compensation.

- Trustworthiness of the Promoter

- Registration ensures that the promoter has disclosed critical details, including past project completions and financial credentials. This builds trust in the developer's ability to execute and complete the project as planned.

Steps to Verify Registration

Ensuring the project and promoter are registered with MahaRERA is simple and can be done online. Follow these steps:

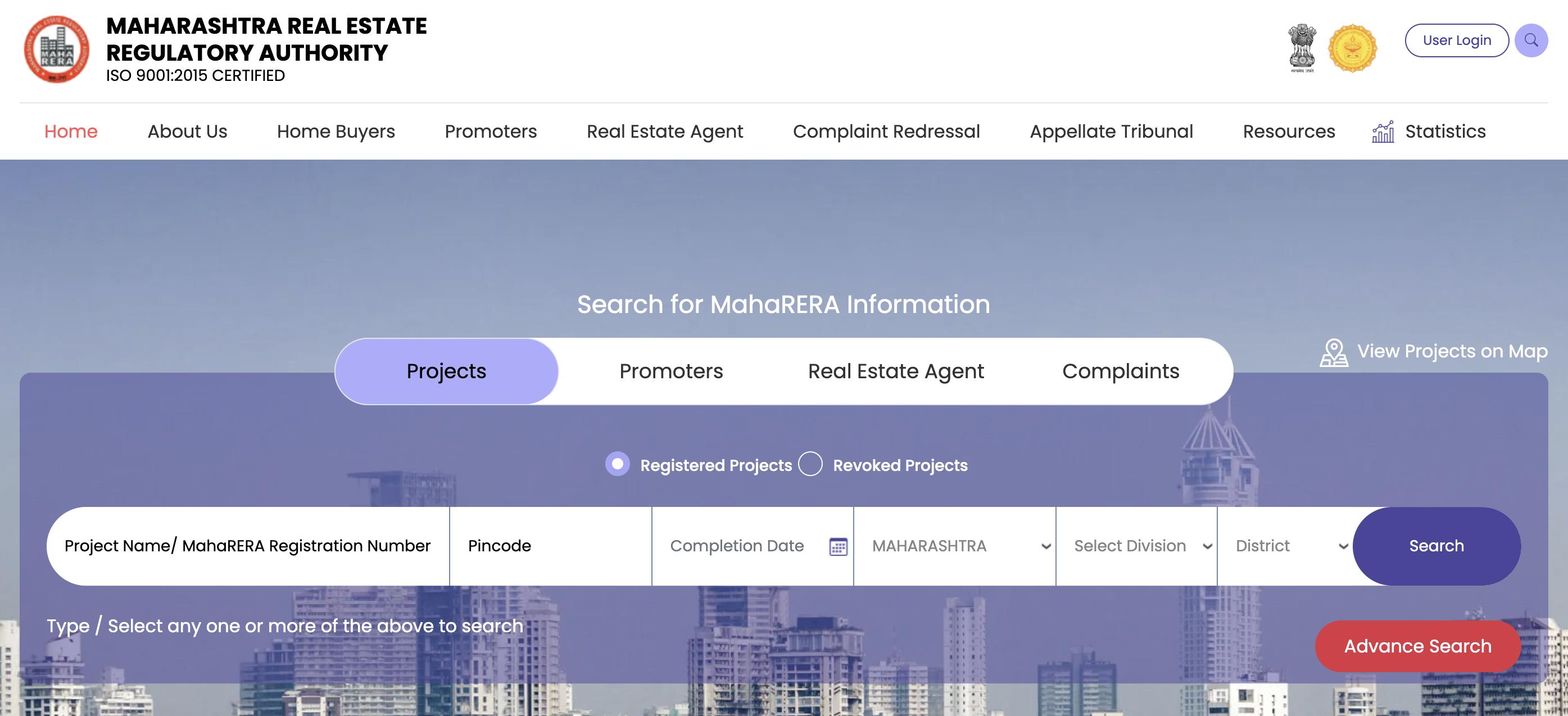

MahaRERA Portal

MahaRERA Portal

- Visit the Official MahaRERA Website

- Navigate to the MahaRERA portal. The website is user-friendly and provides a comprehensive database of registered projects and promoters.

- Search for the Project or Promoter

- Use the search bar to input the project's name, promoter's name, or registration number. The system will display all matching records along with relevant details.

- Review the Registration Details

- Check for the following key documents and information:

- Commencement Certificate (CC): Confirms that the project has received approval to begin construction.

- Layout and Building Plans: Ensures the project's structure and facilities align with what was advertised.

- Financial Disclosure: Verifies that the promoter has adequate funding to complete the project.

- Completion Timelines: Provides clarity on when the project and its amenities are expected to be delivered.

- Verify the Promoter's Credentials

- Check the promoter's track record, including past projects, customer reviews, and any ongoing litigation. This can provide insights into their reliability and reputation.

- Cross-Check Approvals

- Confirm that the project has all necessary government approvals, including environmental clearance, fire safety certifications, and occupancy certificates, as applicable.

Additional Tips

- Bookmark Important Documents: Save or print copies of crucial documents such as the registration certificate, layout plans, and approval letters for your reference.

- Seek Clarifications: If you encounter any discrepancies or unclear details, contact MahaRERA or the concerned promoter directly for clarification.

- Consult a Legal Expert: If you are unfamiliar with real estate terminology or legal procedures, consulting a property lawyer can help ensure that all documentation is in order.

Also Read: 15 Things to Ask Your Builder Before Buying an Under Construction Property

Scrutinize the Agreement for Sale

The Agreement for Sale is a critical legal document between the buyer and promoter. Under MahaRERA, it is standardized to protect buyers' interests and ensure transparency. A thorough review of this document is essential before signing.

Key Elements to Review

- Total Cost: Clearly outlines property costs, including parking, amenities, and taxes. Ensure there are no hidden fees.

- Delivery Timelines: Specifies possession dates and timelines for amenities like clubhouses or pools, ensuring accountability.

- Payment Terms: Payments must align with construction milestones to prevent undue financial stress.

- Refund Policies: Defines terms for cancellations and refunds, safeguarding buyers from project delays or disputes.

- Property Details: Lists specifics like carpet area, layout plans, and materials to ensure you receive what is promised.

Key Update

Developers must now disclose brokerage fees and other additional costs upfront, ensuring full transparency in transactions.

Compare the agreement with the MahaRERA-provided template and seek legal assistance for clarity on complex clauses. This step ensures financial clarity, legal protection, and accountability.

Also Read: RERA Carpet Area: Meaning, Importance, Calculations and More

Confirm Delivery Timelines for Amenities

Amenities like clubhouses, swimming pools, and landscaped gardens significantly enhance the value of a property. However, delayed delivery of amenities is a common grievance among homebuyers.

Swimming Pool in Amenities

Swimming Pool in Amenities

MahaRERA's Rule

- Developers must provide precise timelines for completing amenities, as specified in the Agreement for Sale.

- Failure to deliver amenities within the stipulated time can result in penalties or legal actions.

Why It's Important

- Buyers can avoid indefinite delays, which affect the overall quality of life and property valuation.

- Clear timelines ensure the promoter's accountability.

Action Steps

- Cross-check promised amenities on the MahaRERA website under project details.

- Retain copies of all agreements for future reference.

Also Read: What Do Homebuyers Need to Know About MahaRERA's Project Grading

Understand the Implications of Project Delays

Even with a robust regulatory framework like MahaRERA, project delays can still occur due to unforeseen circumstances such as funding issues, construction delays, or external factors like regulatory clearances. MahaRERA has established clear provisions to protect buyers' interests in such scenarios, ensuring accountability from developers.

Compensation for Delays

- Mandatory Compensation:

- If a promoter fails to deliver possession within the agreed timeline, buyers are entitled to compensation.

- This compensation often takes the form of interest payments on the amount paid by the buyer, calculated until the delayed possession is granted.

- Developer Accountability:

- Extensions granted to developers by MahaRERA do not absolve them of their responsibility to compensate buyers.

- This ensures that developers remain accountable for delays, even when regulatory approvals or force majeure events are cited as reasons.

Key Updates

- Revised Compensation Rates:

- Buyers are now entitled to interest compensation equivalent to the SBI MCLR rate + 2% for the period of delay. This ensures fair financial redressal for buyers.

- Stricter Penalties:

- MahaRERA has introduced higher penalties for developers who repeatedly fail to meet deadlines or comply with project timelines.

- Developers with a history of delays may face restrictions on new project approvals or heavier financial penalties.

- Transparency Requirements:

- Developers must now regularly update project progress on the MahaRERA portal, ensuring buyers have access to accurate information.

Steps for Buyers

- Regularly Monitor Project Status:

- Use the MahaRERA portal to track construction progress, financial disclosures, and updates on possession timelines.

- Stay informed about the project's compliance with its original commitments.

- Understand Your Rights:

- Familiarize yourself with your right to compensation under MahaRERA. Compensation applies not only to delayed possession but also to deviations in promised amenities or layouts.

- File a Complaint if Necessary:

- If the delay persists beyond the permissible timeline, file a complaint on the MahaRERA portal.

- Include all relevant documents, such as the Agreement for Sale and payment receipts, to support your claim.

- Seek Legal Assistance:

- If required, consult a legal expert to ensure that your claim for compensation is accurately filed and presented.

Why This Matters

Delays in real estate projects can disrupt a buyer's financial planning and personal goals. MahaRERA's provisions ensure that developers are held accountable, and buyers are compensated fairly for the inconvenience and financial strain caused by such delays. By understanding your rights and taking proactive measures, you can safeguard your investment and minimize the impact of delays.

Ensure Compliance with RERA Regulations

Understanding MahaRERA regulations is crucial for homebuyers to safeguard their investments, hold developers accountable, and effectively address disputes. MahaRERA establishes a balanced framework that outlines both the rights and responsibilities of buyers and developers, ensuring transparency and fairness in real estate transactions.

Buyers' Rights

- Timely Possession:

- Developers are legally bound to adhere to possession timelines specified in the Agreement for Sale.

- In cases of delay, buyers are entitled to compensation, including interest on payments made.

- Quality Assurance:

- Buyers have the right to demand rectification of structural defects identified within five years of possession.

- Developers must address such issues without additional charges to the buyer.

- Complete Information:

- Buyers are entitled to access all project-related information, such as:

- Approved layout and building plans.

- Completion timelines and progress updates.

- Details of common amenities and their delivery schedules.

- This transparency ensures buyers are fully aware of the project's status and compliance.

- Refund Rights:

- In case of project cancellation or deviations from agreed terms, buyers can demand a full refund along with applicable interest.

Buyers' Duties

- Timely Payments:

- Buyers must adhere to the payment schedules outlined in the Agreement for Sale. Delayed payments may attract penalties or legal action by the developer.

- Adherence to Terms:

- Buyers must comply with the terms specified in the agreement, including responsibilities related to maintenance charges or adhering to community guidelines.

- Regular Communication:

- Buyers should maintain open communication with the developer and promptly address queries or discrepancies.

MahaRERA's Dispute Redressal Mechanism

MahaRERA Dispute Redressal

MahaRERA Dispute Redressal

MahaRERA provides a streamlined grievance redressal platform to resolve disputes efficiently. This mechanism is designed to protect buyers' rights and ensure accountability from developers.

- Filing a Complaint:

- Buyers can file complaints online through the MahaRERA portal.

- Required documents include:

- Agreement for Sale.

- Payment receipts.

- Supporting evidence of the complaint (e.g., emails, brochures, etc.).

- Resolution Process:

- MahaRERA reviews the complaint and mediates between the buyer and the developer.

- In case of unresolved disputes, the matter can escalate to the Appellate Tribunal or a civil court.

- Timeline for Resolutions:

- MahaRERA aims to resolve complaints within a stipulated timeframe to avoid prolonged legal battles.

Importance of Compliance

By ensuring compliance with MahaRERA regulations, buyers can:

- Minimize Risks: Protect their investments by ensuring the developer adheres to legal obligations.

- Enhance Transparency: Gain access to complete project-related details, preventing misinformation.

- Secure Legal Recourse: Utilize the regulatory framework to address grievances and seek compensation for delays or non-compliance.

Pro Tip:

- Stay informed about updates to MahaRERA regulations, as periodic changes may introduce new rights or responsibilities for buyers and developers.

Pro Tips for Homebuyers in 2025

- Check Financial Health of Developers: Beyond registration, assess the developer's financial stability through project reports available on MahaRERA.

- Verify Legal Approvals: Ensure all approvals, including land use permissions and environmental clearances, are in place.

- Cross-Check Advertised Claims: Match promotional claims with registered project details to avoid discrepancies.

- Consult Experts: Seek professional advice for legal and technical due diligence.

- Stay Updated: Regularly visit the MahaRERA website for updates on regulatory changes.

Conclusion

In 2025, MahaRERA continues to be a cornerstone of transparency and accountability in Maharashtra's real estate market, empowering homebuyers with the tools and rights to make informed decisions. By verifying project and promoter registration, scrutinizing the Agreement for Sale, ensuring compliance with regulations, and understanding the implications of project delays, buyers can safeguard their investments and enjoy peace of mind. Staying informed about your rights and responsibilities under MahaRERA ensures a smooth and secure property purchase journey, free from unnecessary risks and disputes.

explore further

Latest from MahaRERA

More from All about rera

Resources

Dwello, for every home buyer, is a way to go from 'I feel' to 'I know', at no extra cost.