Table of Contents

- Introduction

- Types of Municipal Corporations in Delhi

- Delhi Municipal Corporation (MCD) Property Tax Rates

- Calculating Property Tax

- Steps to Pay MCD Property Tax Online in 2025

- Paying Tax Offline

- Exemptions and Rebates in MCD Property Tax for Delhi

- Penalty for Delayed Payment of MCD Property Tax in Delhi

- Conclusion

- Faq's

Introduction

Property tax in Delhi is a mandatory levy imposed by the Municipal Corporation of Delhi (MCD) on individuals who own property in the city. This tax is a vital source of revenue for the local municipal authorities and is used to fund essential civic services and infrastructure. Property owners, including those with vacant land, are required to pay this tax annually.

The MCD in Delhi uses the Unit Area System to calculate property tax, a method recommended by the Government of India. Under this system, the tax amount is determined based on factors such as the built-up area of the property, the construction period, the building's structure, its location, and its designated use.

There are different property tax rates for various types of properties, including residential, rented residential, commercial, and industrial properties. Property tax is crucial for the maintenance and improvement of city services, and property owners must comply with the payment requirements to support the local infrastructure and amenities provided by the municipal authorities.

Types of Municipal Corporations in Delhi

If you own residential property in Delhi, you are required to pay property tax to one of the three Municipal Corporations established in 2012 to replace the unified Delhi municipal corporation. Property owners can conveniently make their payments through the online portals of these corporations, and timely payments are essential to avoid penalties.

East Delhi Municipal Corporation (EDMC):

EDMC has been split into two zones, namely Shahdara North and Shahdara South. These zones are further divided into six wards, with each ward consisting of five colonies.

Property owners in East Delhi need to visit the official website to fulfill their property tax obligations.

South Delhi Municipal Corporation (SDMC):

SDMC encompasses six zones: City-SP Zone, Civil Lines, Karol Bagh, Narela, Rohini, and Keshav Puram.

Residents in North Delhi must pay property tax within the stipulated deadlines to the North Delhi Municipal Corporation.

North Delhi Municipal Corporation (NDMC):

NDMC is divided into five zones: Central, South, West, and Najafgarh.

Property owners in any of these zones within South Delhi are obligated to pay property tax, and both offline and online modes of payment are available through the official portal.

Property owners must stay informed about the specific deadlines and payment procedures relevant to their respective Municipal Corporations to ensure compliance with property tax regulations.

Delhi Municipal Corporation (MCD) Property Tax Rates

| Category of Property | Residential | Commercial | Industrial | Unit Area Value (UAV) - Rate per sq. meter |

| A | 12% | 20% | 15% | Rs.630 |

| B | 12% | 20% | 15% | Rs.500 |

| C | 11% | 20% | 12% | Rs.400 |

| D | 11% | 20% | 12% | Rs.320 |

| E | 11% | 20% | 12% | Rs.270 |

| F | 7% | 20% | 10% | Rs.230 |

| G | 7% | 20% | 10% | Rs.200 |

| H | 7% | 20% | 10% | Rs.100 |

Calculating Property Tax

The Municipal Corporation of Delhi employs the 'Unit Area System' to calculate property tax across the city. Understanding how to calculate house tax involves several factors, and the formula is detailed below:

House Tax Calculation Formula

House Tax = Annual Value * Rate of Tax

Annual Value Calculation

The annual value is determined by considering various factors:

Annual Value = Unit Area Value * Unit Area of Property * Age Factor * Use Factor * Structure Factor * Occupancy Factor

|

Factor |

Description |

Range |

|

Unit Area Value |

Value per square meter assigned to the built-up area of the property. |

- |

|

Unit Area of Property |

The built-up area, not the carpet area, per square meter. |

- |

|

Age Factor |

Newer properties incur higher taxes compared to older ones. The factor ranges from 0.5 to 1. |

0.5 to 1 |

|

Use Factor |

Residential properties have a lower tax rate compared to non-residential properties. |

1 |

|

Structure Factor |

RCC constructions are taxed more than low-value constructions. |

- |

|

Occupancy Factor |

Properties that are rented out face higher taxes compared to self-occupied properties. |

- |

Rate of Tax

The rate of tax varies for categories A- H and is published annually by the MCD. Refer to the official MCD Property Tax website for the applicable rates.

Illustrative Example

Let's consider an illustrative example to understand the calculation:

Assume:

• Unit Area Value = Rs. 6000 per sq. meter

• Unit Area of Property = 120 sq. meters

• Age Factor = 0.8

• Use Factor = 1 (for residential property)

• Structure Factor = To be determined based on construction type

• Occupancy Factor = To be determined based on property status

Calculate the Annual Value using the formula provided.

Once the Annual Value is determined, multiply it by the Rate of Tax for the respective category to obtain the House Tax.

This comprehensive guide provides a clear understanding of the factors involved in calculating property tax in Delhi using the Unit Area System. Refer to the official MCD Property Tax website for the latest rates and further assistance.

Steps to Pay MCD Property Tax Online in 2025

Paying your MCD Property Tax online is a convenient and efficient process. Follow these steps to complete the payment seamlessly:

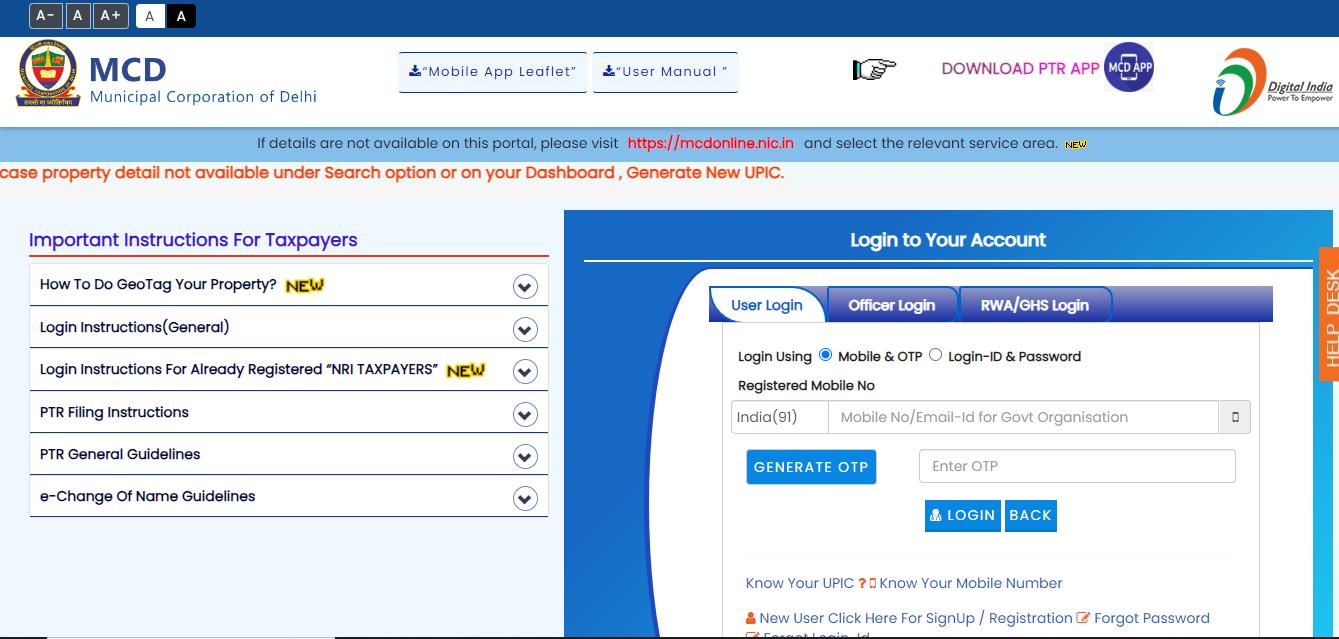

Step 1: Visit the Official MCD Website

Visit the official MCD website

Step 2: Generate OTP

Provide your registered mobile number and click on Generate OTP to receive a one-time password.

Step 3: Login

Enter the received OTP and click on Login. If you are a new user, opt for the SignUp / Registration option.

Step 4: View Property Details

Upon logging in, you will be presented with a detailed overview of property information, including UPIC, Property Type, Owner Type, Name, Address, Status, and Registration Details.

Step 5: Initiate Payment

Click on the Actions button and select the Pay Tax option.

Step 6: Choose the Financial Year

Choose the relevant financial year for which you want to pay the property tax and click on Submit.

Step 7: Verify Property Details

A pop-up will appear, prompting you to confirm any modifications or changes in Property/Owner Details since the last tax payment.

Step 8: Editing Details

If necessary, choose Yes, I want to Edit before I Pay or proceed with No, I want to Pay.

Step 9: Tax Calculator

You will be redirected to the Tax Calculator page, presenting detailed property information and displaying applicable rebate percentages.

Step 10: Download PDF

Review all details, then click on Download PDF before selecting the Pay Tax button.

Step 11: Choose Payment Mode

Select your preferred payment mode Credit card, debit card, or net banking. You can go to Pay Now to make the payment.

Step 12: Confirmation

Upon successful payment, the status will be displayed as Success. Download the receipt for your future reference.

This step-by-step guide ensures a smooth online MCD Property Tax payment process, offering convenience and transparency in managing your property taxes.

Paying Tax Offline

• Opting for offline payment of Delhi house tax is a viable alternative for those who prefer not to pay online.

• Choose from 800 strategically located ITZ cash counters across Delhi to make your property tax payment in person.

• Upon completing the offline payment, you will receive an immediate receipt that includes a unique property tax ID.

• This property tax ID is crucial for all your future tax payments, and it is recommended to use it consistently.

• It is essential to remember and use your assigned ID; failure to do so might lead to the system generating a new ID, causing potential issues during future transactions.

• Neglecting to use the previously allotted ID could result in complications and may even attract punitive action.

• Stay organized and ensure a smooth experience for all your property tax transactions by keeping track of and using the property tax ID provided with your offline payment receipt.

Exemptions and Rebates in MCD Property Tax for Delhi

Exemptions

Bodies/Individuals Exempted from Payment:

- Vacant Land or Buildings: Used as a place of worship, public burial, heritage land, or for charitable purposes by anybody or individual.

- Agricultural Land or Building: Exempt from property tax.

- Land or Building Vested in Corporation: Properties owned by corporations are exempt.

- Ex-Servicemen or Widow of Martyr: Property used as a self-residence with no portion let out.

- Martyred on Paramilitary or Police Duty: Exemption for properties of individuals martyred on duty.

- South MCD Employee with Disability: Fully handicapped but actively on duty.

- International Award-Winning Sportsperson: Exemption for achievements in international games.

Rebates

- Lump Sum Payment Rebate: A 15% discount on the total tax amount for payments made in the first quarter of the year.

- Specific Property Type Discounts:

- DDA/CGHS Flats: A 10% discount on the annual value, applicable up to 100 square meters.

- Women, Physically Challenged Individuals, and Senior Citizens: A 30% discount on property tax, but only for one property.

- Ex-Servicemen: A 30% discount on property tax.

- Group Housing Flats: A 20% discount if paid up to 30th June of the financial year.

Conditions for Availing Rebates:

- Rebates are eligible for properties with an area of up to 200 square meters, except for DDA/CGHS flats, which have a limit of 100 square meters.

- Residential occupancy and self-occupied use factors are prerequisites for availing rebates.

- In cases of joint ownership, concessions are granted based on the property share of qualifying owners.

Penalty for Delayed Payment of MCD Property Tax in Delhi

Should you fail to make the timely payment of your property tax, the Municipal Corporation of Delhi (MCD) imposes a penalty as a consequence. The penalty accrues at a rate of 1% per month on the outstanding tax amount.

Key Points Regarding Penalty:

1. Monthly Fine: The penalty is calculated every month, amounting to 1% of the unpaid tax for each month of delay.

2. Deadline Announcement: The Delhi Municipal Corporation (DMC) establishes a specific deadline for property tax payments, which is crucial to adhere to in order to avoid incurring penalties.

3. Accrual Period: The penalty starts accumulating from the day following the expiration of the stipulated deadline for tax payment.

4. Timely Compliance: To prevent the imposition of penalties, it is essential to stay informed about the announced deadlines and ensure timely compliance with property tax payments.

5. Financial Implications: Payment delays not only result in penalties but may also have financial implications, emphasizing the importance of adhering to the designated timelines.

By understanding and adhering to the deadlines set by the Delhi Municipal Corporation, property owners can avoid unnecessary penalties and contribute to the efficient functioning of the tax payment system. Stay informed to ensure a smooth and penalty-free experience in managing your MCD property tax obligations.

Conclusion

For prospective homebuyers in Delhi, understanding the intricacies of property tax is essential as it forms a significant aspect of homeownership. The Municipal Corporation of Delhi (MCD) has outlined clear procedures, both online and offline, for property tax payments, and staying informed about these processes is crucial.

As a homebuyer, it is essential to be aware of the various exemptions and rebates available. Knowing that certain properties, such as those used for charitable purposes or owned by ex-servicemen, may be exempted from property tax can influence decisions during the property search. Additionally, being cognizant of rebates, such as those for prompt lump-sum payments or specific property types, can contribute to long-term cost savings.

Delays in property tax payments can result in penalties, impacting a homeowner's financial obligations. Therefore, homebuyers should prioritize understanding the deadlines and procedures to avoid unnecessary fines.

In conclusion, a homebuyer's journey extends beyond the purchase of the property; it involves ongoing responsibilities such as property tax payments. Staying informed about these obligations empowers homebuyers to navigate the homeownership landscape seamlessly, ensuring compliance with regulations and contributing to the well-being of the community.

explore further

Latest from Home Buying Tips

More from Recommendations

Resources

Dwello, for every home buyer, is a way to go from 'I feel' to 'I know', at no extra cost.