Table of Contents

- Introduction

- Who Needs To Pay PMC Property Tax?

- Factors Affecting Panvel Municipal Corporation Property Tax

- Different Property Categories and Their Tax Rates in Panvel

- Steps to Pay Panvel Municipal Corporation Property Tax Online

- Panvel Municipal Corporation Customer Care Details

- Conclusion

- Faq's

Introduction

Panvel, located within the Mumbai Metropolitan Region (MMR) in Maharashtra, is governed by the Panvel Municipal Corporation (PMC). This authority is tasked with assessing and collecting property taxes for all properties within its jurisdiction.

Property tax is a vital source of revenue for local governments, enabling them to fund essential services such as infrastructure maintenance, public health initiatives, waste management, and educational facilities. The PMC has established a user-friendly online system that allows taxpayers to calculate and pay their property taxes efficiently.

The property tax system in Panvel is designed to be transparent and accessible, ensuring that residents can easily understand their obligations. The PMC employs various methods to determine the tax amount owed by property owners, taking into account factors such as property type, location, and size. This comprehensive approach helps ensure that the tax burden is fairly distributed among residents while providing necessary funds for community services.

In recent years, the PMC has made significant strides in enhancing the online payment process, allowing residents to manage their property tax payments from the comfort of their homes. This modernisation reflects a broader trend among municipal governments to leverage technology for improved service delivery. The PMC's commitment to transparency and efficiency is evident in its efforts to keep residents informed about their tax obligations and available exemptions.

Understanding how property tax works in Panvel is crucial for homeowners and investors alike. By familiarising themselves with the assessment process, payment options, and potential exemptions, residents can better navigate their responsibilities and contribute to the growth and development of their community.

Who Needs To Pay PMC Property Tax?

Anyone who owns any type of property in the city is eligible to pay the property tax per year. This tax is similar to the BBMP property tax in Bangalore, MCC property tax in Mysore, Nagpur property tax, Aurangabad property tax, and others. Well, this applies to the owners of the following property types-

- Residential included houses, villas, apartments, etc.

- Commercials including shops, offices, hotels, etc.

- Industrial including factories, warehouses, etc.

- Vacant Lands that are not built upon

For further clarification, you can contact Panvel property tax helpline number 1800-5320-340 from Monday to Friday, 10 AM to 6 PM.

Also Read: Vasai Virar Gharpatti 2024: A Guide to Property Tax Payment

Factors Affecting Panvel Municipal Corporation Property Tax

Several factors influence the calculation of property tax in Panvel, making it essential for property owners to understand these elements to anticipate their tax liabilities accurately.

Age of the Property

The age of a property significantly impacts its tax liability. Generally, older properties tend to have higher assessed values due to established infrastructure and amenities in their vicinity. Conversely, newly constructed properties may have lower initial assessments as they are still developing their surrounding neighborhoods. This dynamic can lead to varying tax obligations based on the property's age.

Base Value

The base value is a critical component in determining property tax rates. The PMC establishes this value based on multiple criteria, including location desirability, accessibility to public transport, proximity to commercial hubs, and available civic amenities such as schools and hospitals. Properties situated in prime locations typically have higher base values, leading to increased tax liabilities.

Built-Up Area

The size of the property also plays a vital role in tax assessment. The built-up area encompasses all usable space within a property, including floors and any extensions. Larger properties with more square footage will naturally incur higher taxes compared to smaller units. The PMC considers both residential and commercial properties when calculating built-up area metrics.

Property Category

Different types of properties are subject to varying tax rates based on their usage classification. For instance, residential properties usually attract lower rates compared to commercial or industrial properties due to the different services provided by the PMC. Additionally, agricultural lands may have entirely different taxation rules or exemptions compared to urban properties.

By understanding these factors, property owners can make informed decisions regarding their real estate investments while ensuring compliance with local taxation laws.

Different Property Categories and Their Tax Rates in Panvel

The Panvel Municipal Corporation (PMC) categorises properties based on their usage and type, which directly influences the property tax rates applied to each category. Understanding these classifications is essential for property owners to anticipate their tax liabilities accurately. Below are the primary property categories recognized by the PMC along with their respective tax rates.

1. Residential Properties

Residential properties are primarily used for living purposes. This category includes individual houses, apartments, and residential complexes. The tax rate for residential properties in Panvel is generally lower compared to commercial or industrial properties.

2. Commercial Properties

Commercial properties are utilised for business activities, including offices, retail shops, and service establishments. Given their potential for generating revenue, commercial properties are subject to higher tax rates than residential ones.

3. Industrial Properties

Industrial properties encompass factories, warehouses, and manufacturing units. The PMC recognises the importance of industrial development for economic growth; thus, the tax rates for these properties may vary based on size and location.

4. Mixed-Use Properties

Mixed-use properties combine residential and commercial functions, such as buildings that have shops on the ground floor and apartments above them. The tax rate for mixed-use properties is usually a blend of the rates applicable to both residential and commercial categories.

5. Agricultural Properties

Agricultural lands are typically exempt from property taxes or may be subjected to significantly reduced rates due to their use in farming activities. However, any non-agricultural use of such lands may trigger standard property tax rates.

6. Institutional Properties

Properties used for educational purposes, such as schools and colleges, fall under this category. The PMC may offer concessions or reduced rates to promote educational institutions within its jurisdiction.

Also Read: How to Pay MCGM Property Tax in Mumbai -2024

Steps to Pay Panvel Municipal Corporation Property Tax Online

The Panvel Municipal Corporation has streamlined the process for paying property taxes online, making it easier for residents to fulfill their obligations without visiting municipal offices physically. Here's a detailed guide on how to navigate this online payment system:

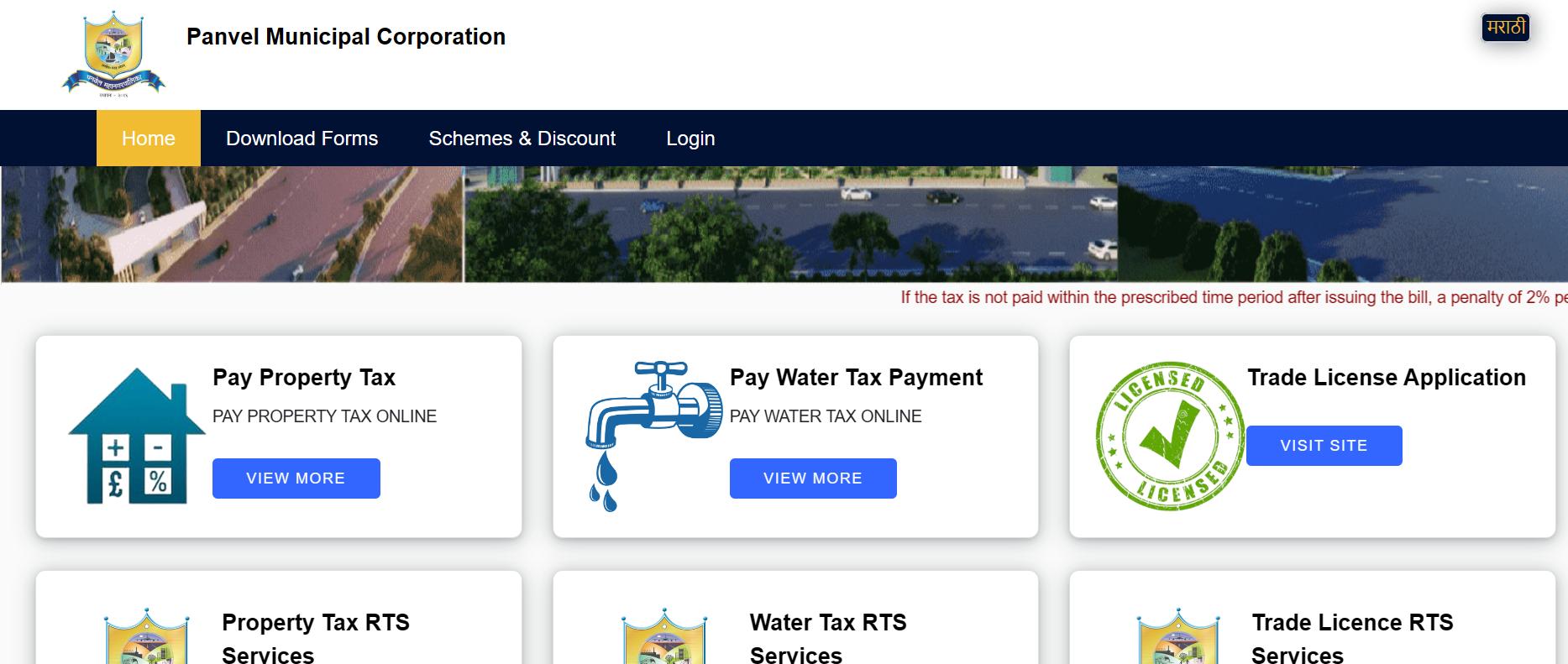

Step 1: Access the Official Website

Begin by visiting the official website of the Panvel Municipal Corporation at panvelcorporation.com. This site serves as a central hub for various municipal services, including property tax payments.

Step 2: Login or Create an Account

Once on the homepage, you will need to log in using your existing account credentials. If you do not have an account yet, you can create one by following the registration prompts provided on the website.

Step 3: Locate Property Tax Payment Section

After logging in successfully, navigate to the Pay Property Tax section prominently displayed on the homepage. This section contains all necessary tools for managing your property tax payments.

Step 4: Enter Property Details

To proceed with your payment, you will need to enter specific details related to your property. This includes your bill number and address information. Ensure that all details are accurate to avoid any discrepancies during processing.

Step 5: Calculate Your Tax

Utilise the PMC's online property tax calculator available on the site. This tool will help you determine your payable amount based on current rates and your property's assessed value. After calculating your dues, generate a challan that includes all relevant details about your payment.

Step 6: Select Payment Method

Choose from various payment methods available on the platform these may include credit/debit cards or net banking options. Follow the prompts to complete your transaction securely.

Step 7: Download Receipt

Once your payment is processed successfully, make sure to download and save your receipt as proof of payment. This document may be required for future reference or disputes regarding your tax status.

By following these steps diligently, residents can ensure timely payment of their property taxes while avoiding penalties associated with late payments.

Panvel Municipal Corporation Customer Care Details

For any inquiries or assistance related to property taxes or other municipal services, residents can reach out through various customer care channels provided by the Panvel Municipal Corporation:

Contact Information Details

- Contact Number 1800-227701 / 02227458040

- Email Address panvelcorporation@gmail.com

- Official Website panvelcorporation.com

- Office Address Swami Nityanand Road, Opposite Gokhale Marriage Hall, Panvel, Navi Mumbai - 410206

Conclusion

Understanding how property tax functions within the framework of local governance is essential for all homeowners and investors in Panvel. By familiarising themselves with key aspects such as calculation methods, payment processes, and available exemptions, residents can effectively manage their financial responsibilities while contributing positively to community development initiatives funded by these taxes.

The Panvel Municipal Corporation's efforts toward modernising its services through online platforms reflect a commitment to enhancing taxpayer experience while ensuring compliance with local laws. As civic needs evolve alongside urban development in Panvel, staying informed about property taxation will empower residents not only in fulfilling their obligations but also in advocating for improvements within their community based on equitable resource allocation derived from these funds.

explore further

Latest from Home Buying Tips

More from Recommendations

Resources

Dwello, for every home buyer, is a way to go from 'I feel' to 'I know', at no extra cost.